In today’s tough job market and economy, it can be hard for an independent adjuster to look for work and meaningful opportunities. The question that many people want to ask, but choose to keep to themselves is, “Which Independent Adjuster Firm Pays the Most?” This is a reasonable question because, in an uncertain job landscape, it is not about accepting every deployment or job opportunity if that opportunity can barely pay the bills! Our goal is to help you land a job opportunity with substantial compensation!

This blog post explores why independent adjusters must carefully assess potential employers. We will provide a list of the top 8 companies to help you determine which independent adjuster firm pays the most, as well as a breakdown of things to consider when looking at the top 8 companies based on our knowledge and expertise. We believe this will help because no one knows how long the uncertainties in our economy will persist and the search for the most financially rewarding independent adjuster firm becomes a vital lifeline for those navigating this unpredictable job market.

Table of Contents

Top 8 Paying Independent Adjuster Companies

For Licensed Independent Insurance Adjusters in the United States according to Glassdoor which independent adjuster firm pays the most.

| # | Independent Adjuster Firm Name | |

|---|---|---|

| 1 | Alacrity Solutions | |

| 2 | QA Claims | |

| 3 | Crawford & Company | |

| 4 | Pilot Catastrophe Services, Inc. | |

| 5 | RENFROE | |

| 6 | Wardlaw Claims Service | |

| 7 | Eberl Claims Service | |

| 8 | TheBest Claims Solutions | |

RELATED: How to Write a Resume for an Insurance Adjuster With No Experience

Things to Consider for Which Independent Adjuster Firm Pays the Most

When independent adjusters are looking for good-paying opportunities, the information we provided above in the Top 8 Paying Independent Adjuster Companies is referenced from Glassdoor and there is limited information provided on what determines the average for each company. The reason we wanted to address this question is because two CRUCIAL things can get lost in translation:

- We do not know if the average pay is for auto-adjusting positions or for property-adjusting positions.

- Also, the site does not specify if the top-paying companies are for desk-adjusting positions or field-adjusting positions.

These details matter a lot for adjusters trying to make smart career choices or even changes. This section of the blog post aims to make things even clearer, stressing the need to understand how pay structures differ in auto and property adjusting and the different aspects of desk and field adjusting roles. By breaking down these details, independent adjusters can make smarter choices that match their skills and financial goals to better understand which independent adjuster firm pays the most.

Which Adjusters Make the Most Money

As we stated initially, when it comes to the earning potential in the world of independent adjusting, the distinction between auto adjusters and property adjusters can be pivotal. Before we dive into the numbers, it should be clear that property adjusters typically bring home bigger checks compared to their auto-adjusting counterparts no matter if you work as a staff adjuster or an independent adjuster.

Why? The complexity and intricacy of property claims often translate to higher compensation. While auto adjusters play a crucial role, navigating the nuances of property claims demands a specialized skill set that comes with a higher reward. Therefore, knowing that property adjusters naturally earn more will help you better understand which independent adjuster firm pays the most by helping you know which opportunities you may want to seek between the two specializations.

For the sake of this blog, we want to make a note that apart from auto and property adjusting, there are several other niches within the independent adjuster field that one could pursue, such as catastrophe adjusting, liability adjusting, and workers’ compensation adjusting. While these areas offer unique challenges and opportunities, auto adjusting and property adjusting remain the go-to starting points for many individuals embarking on a career in adjusting and it is the reason why we only focused on these two career paths for now.

How Much Do Independent Adjusters Make

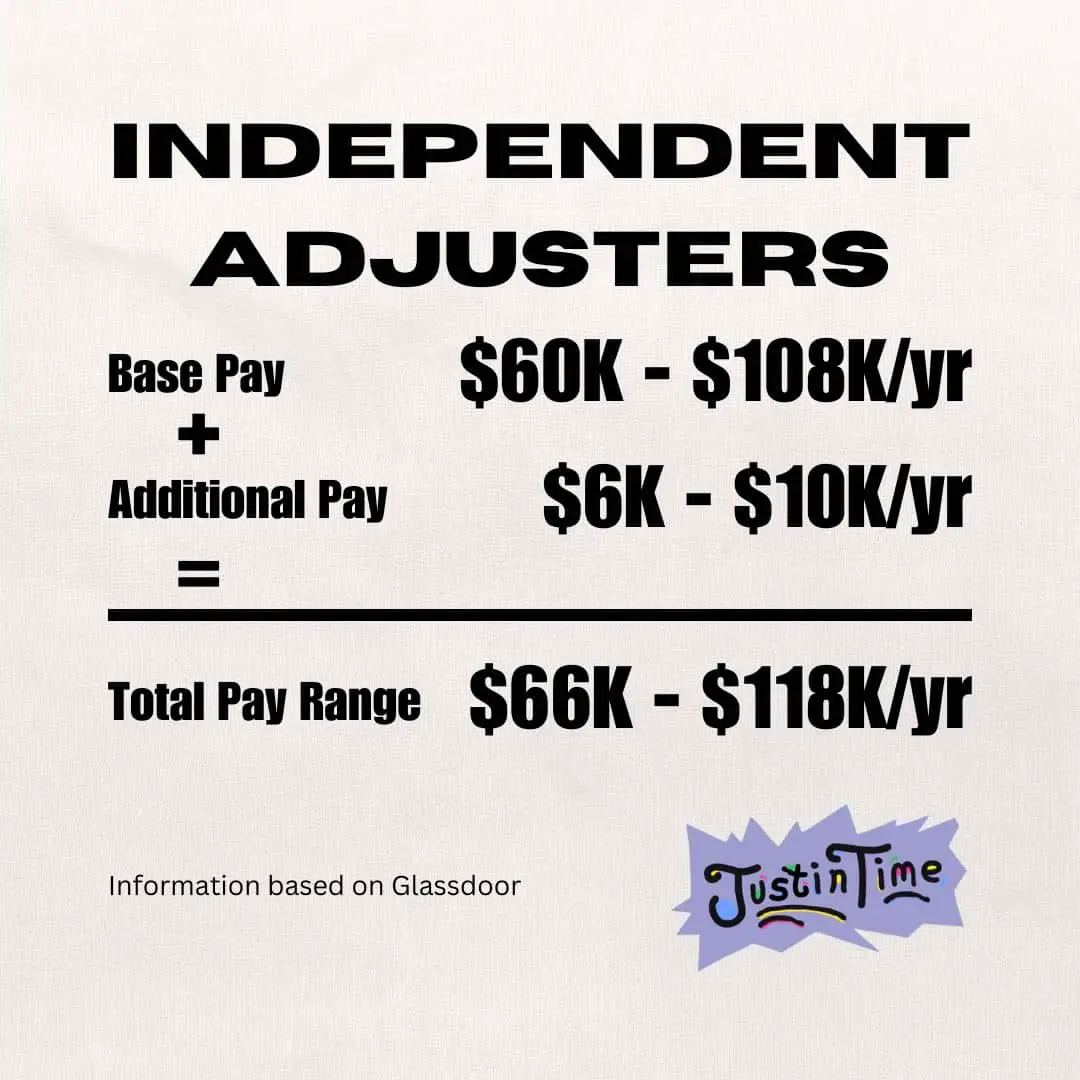

Based on data from Glassdoor, independent adjusters in the United States can anticipate an estimated total pay of $87,647 per year ($42.14 per hour) which is 153% compared to the US median salary1. The average annual salary is reported at $80,296 per year ($38.61 per hour) which is 140% compared to the US median salary1.

It should be noted that an estimated $7,352 in additional pay may come into play based on potential cash bonuses and profit-sharing, which does not factor in overtime or time-in-a-half. The “Total Pay Range” values shown below fall between the 25th and 75th percentiles of all available pay data for this role, providing a comprehensive overview of the potential earnings landscape for independent adjusters.

How Much Do Independent Auto Adjusters Make?

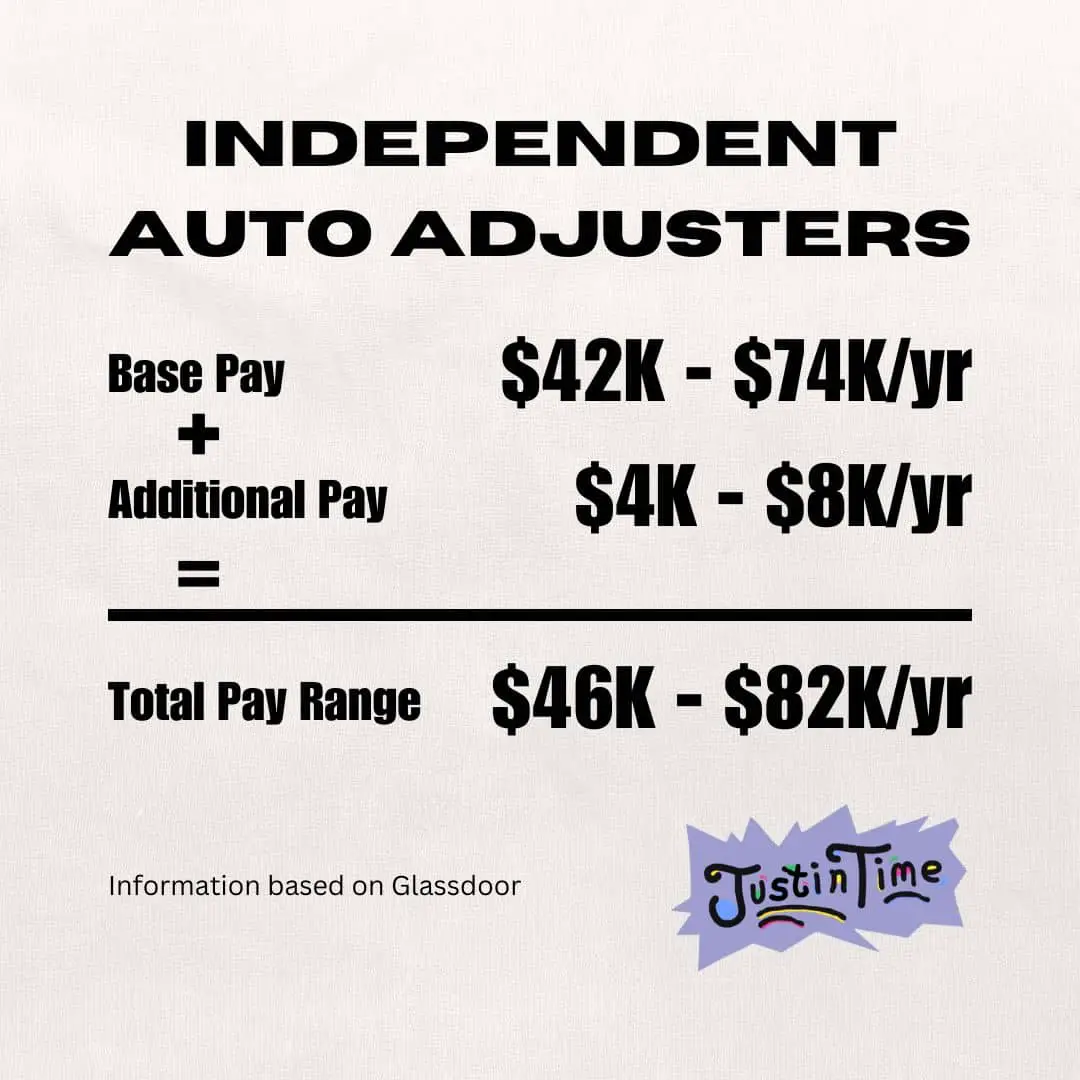

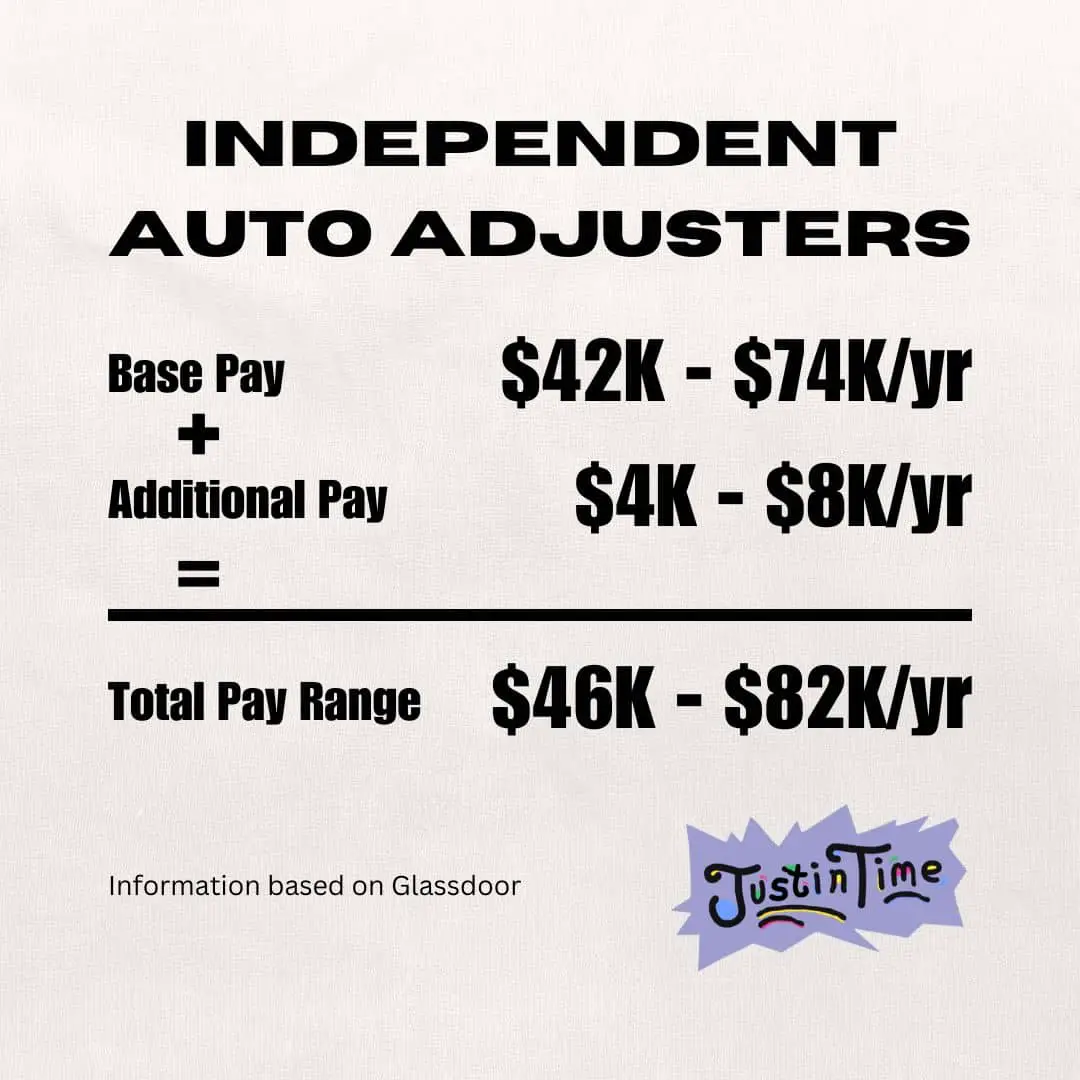

Based on data from Glassdoor, independent auto adjusters in the United States can anticipate an estimated total pay of $61,321 per year ($29.49 per hour) which is 107% compared to the US median salary1. The average annual salary is reported at $55,756 per year ($26.81 per hour) which is 98% compared to the US median salary1.

It should be noted that an estimated $5,565 in additional pay may come into play based on potential cash bonuses and profit-sharing, which does not factor in overtime or time-in-a-half. The “Total Pay Range” values shown below fall between the 25th and 75th percentiles of all available pay data for this role, providing a comprehensive overview of the potential earnings landscape for independent auto adjusters.

How Much Do Independent Property Adjusters Make

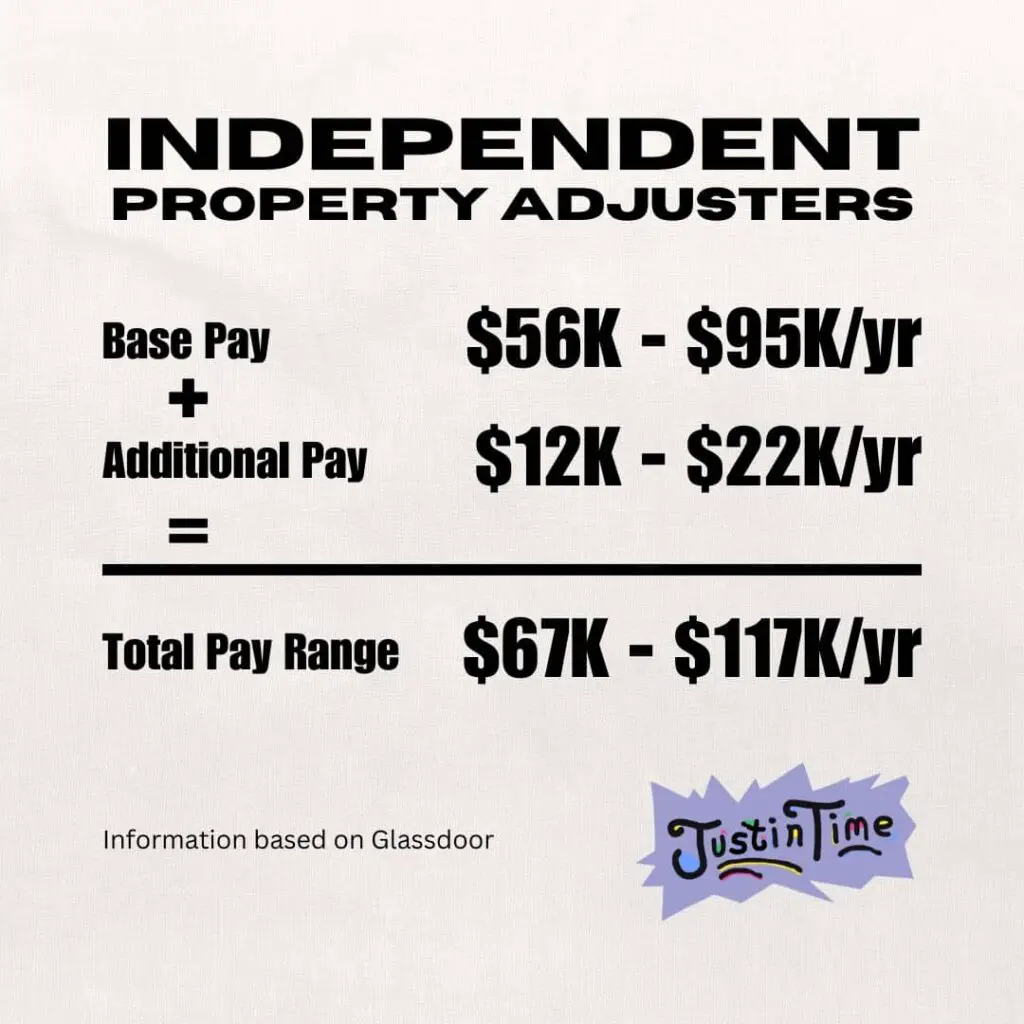

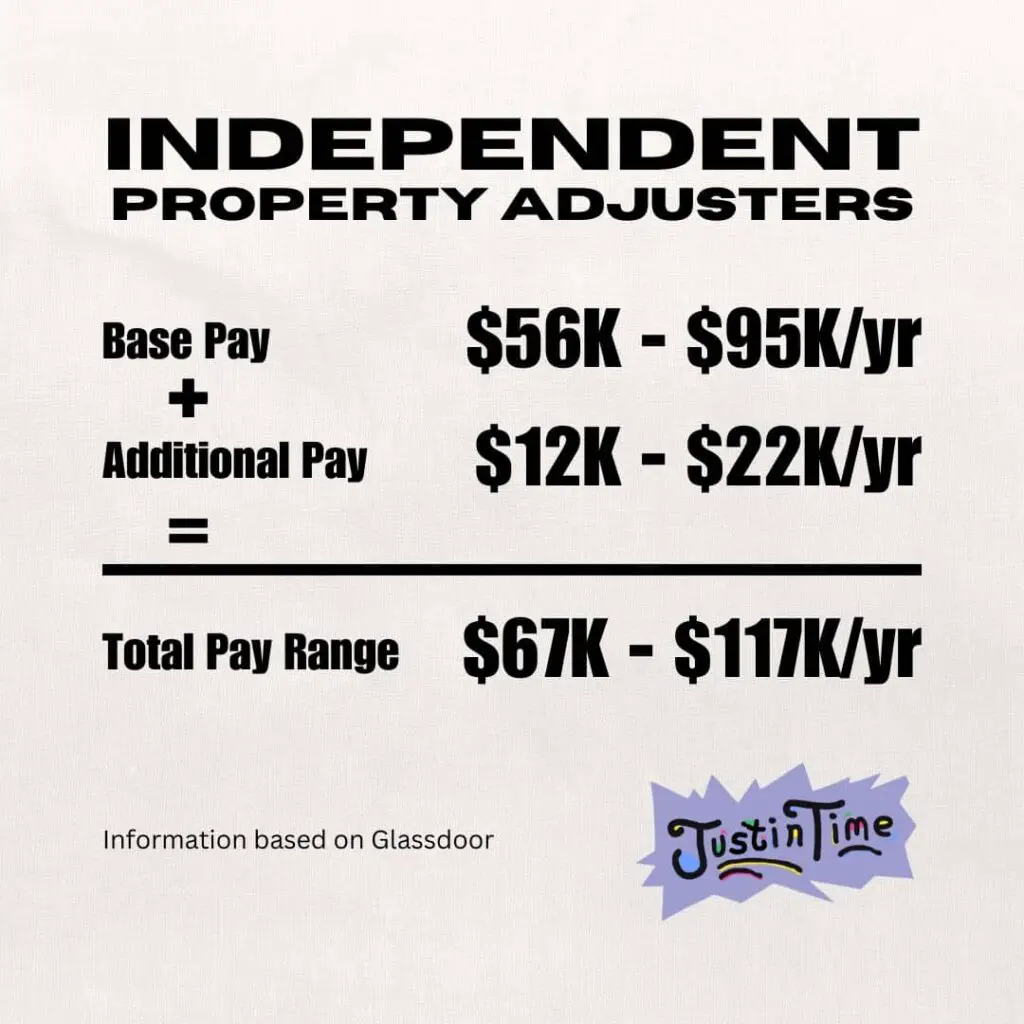

Based on data from Glassdoor, independent property adjusters in the United States can anticipate an estimated total pay of $88,147 per year ($42.38 per hour) which is 154% compared to the US median salary1. The average annual salary is reported at $72,704 per year ($34.96 per hour) which is 127% compared to the US median salary1.

It should be noted that an estimated $15,443 in additional pay may come into play based on potential cash bonuses and profit-sharing, which does not factor in overtime or time-in-a-half. The “Total Pay Range” values shown below fall between the 25th and 75th percentiles of all available pay data for this role, providing a comprehensive overview of the potential earnings landscape for independent property adjusters.

What is the US Median Salary

- Based on the Bureau of Labor Statistics for the U.S. Department of Labor, the median weekly earnings for full-time workers was reported to be $1,118 in the third quarter of 2023 at the time of writing this blog. The yearly salary for this reporting is around $57,200 per year; however, this does not reflect the earning potential considering gender, occupation, state, and several other factors that we cannot consider. ↩︎

Summary of Which Adjusters Make the Most Money

Based on the pictures above and according to available data, property adjusters tend to earn approximately $26,000 more than their auto-adjusting counterparts. This disparity underscores the nuanced nature of compensation within the independent adjusting profession, emphasizing the higher earning potential associated with specializing in property claims. While both roles play integral parts in the insurance ecosystem, aspiring adjusters might find it beneficial to consider the substantial difference in earnings when making informed decisions about their career paths.

Conclusion on Which Independent Adjuster Firm Pays the Most Money

In conclusion, the quest for the most lucrative opportunities in the realm of independent adjusting involves a strategic consideration of specialization and choice of employer. While auto-adjusting may offer an easier entry point for many, those aspiring to maximize their earning potential should turn their attention to the top players in property adjusting.

RELATED: 130+ companies that hire independent insurance adjusters

Our list of the Top 8 Independent Adjuster Firms underscores the financial advantages associated with specializing in property claims. These companies not only provide a wealth of experience but also offer the prospect of significantly higher earnings. Aspiring adjusters are encouraged to weigh the trade-offs, recognizing that while the path of least resistance might be in auto-adjusting, the path to financial prosperity often leads through the doors of the top property-adjusting firms. Making a well-informed decision about where to launch one’s adjusting career can pave the way for both professional growth and financial success.