One of my favorite movies is Training Day featuring Denzel Washington and Ethan Hawke. Now, you may be wondering what the movie Training Day has to do with answering interview questions in the world of claims. If you have been living under a rock and never watched the movie, the opening scene starts with the rookie cop (Ethan Hawke) preparing for his first day to impress the leading detective (Denzel Washington) to join his fast-paced unit. As he meets the lead detective for the first time, Denzel tells him:

“You got TODAY and today only to show me who and what you are made of.”

Denzel Washington, Training Day

So listen up as I do my best Alonzo Harris (the character played by Denzel Washington) impersonation: if you are here because you just got the call for an interview/deployment, today is not the day to be sweatin’ bullets! Unless you have never worked before, you need to remember that this is not your first rodeo.

As someone who was recently in your shoes, I KNOW the streets of job hunting can be mean and cutthroat. I applied to over 100 positions until I learned what helped me land multiple offers, so if you are applying to be a claims adjuster, you need to know ONE thing about answering interview questions: You have to treat the interview or phone call as if you have been here before and the only way to do that is to PREPARE!

With each job interview, you have the opportunity to prove your expertise, professionalism, and adaptability in the insurance claims industry. Navigating the interview process successfully requires a strategic approach, understanding the industry’s demands, and anticipating the questions that might be thrown your way.

To help you prepare, we have compiled a list of questions frequently asked during job interviews for independent claims adjusters, as well as questions I have been asked. Whether you are a seasoned pro or a newbie in the field, these questions and tips will be valuable in ensuring you are ready to shine during your next phone call. So grab a pen because training day starts now!

Understanding the 3 Different Types of Interview Questions

1) Resume Type Interview Questions

In any job interview, you can almost guarantee that you will be asked a few questions related to your resume. There are not a lot of these types of questions, but they are designed to provide the interviewer with a deeper understanding of your professional background, skills, and experiences. They may start with “Can you walk me through your resume/experience?” or “What prompted you to transition from your previous role to this one?”

If you do not have specific experience in claims adjusting, this is not meant to make you feel nervous about your previous experience or even question why you applied. Take this opportunity to showcase the progression of your career, emphasizing key achievements and highlighting how your skills align with the requirements of the claims adjuster position.

Most jobs require “Transferrable Skills” and this gives you to chance to explain what you may not have been able to fit on your resume by highlighting your customer service or attention to detail skills. Be ready to discuss any employment gaps, showcasing the valuable skills and knowledge gained during those periods, ensuring your resume tells a comprehensive and compelling story.

2) Claims Experience Interview Questions

If you happen to have experience in the specialized nature of the claims adjuster role, interviewers will likely delve into your experiences in the insurance industry. You can expect questions such as “What type of licenses do you currently have in your possession” or “How do you stay updated on changes in insurance policies and regulations?” These queries aim to assess your technical proficiency and industry knowledge.

These questions typically call for straightforward responses, not in the STAR method format so keep your answers short and straight to the point. Discuss any relevant certifications, training, or workshops you have completed to highlight your commitment to staying informed and maintaining a high level of expertise in claims adjustment. Besides, you worked hard to get that New York license, so it is okay to emphasize how you studied for it while still being able to prioritize your workload!

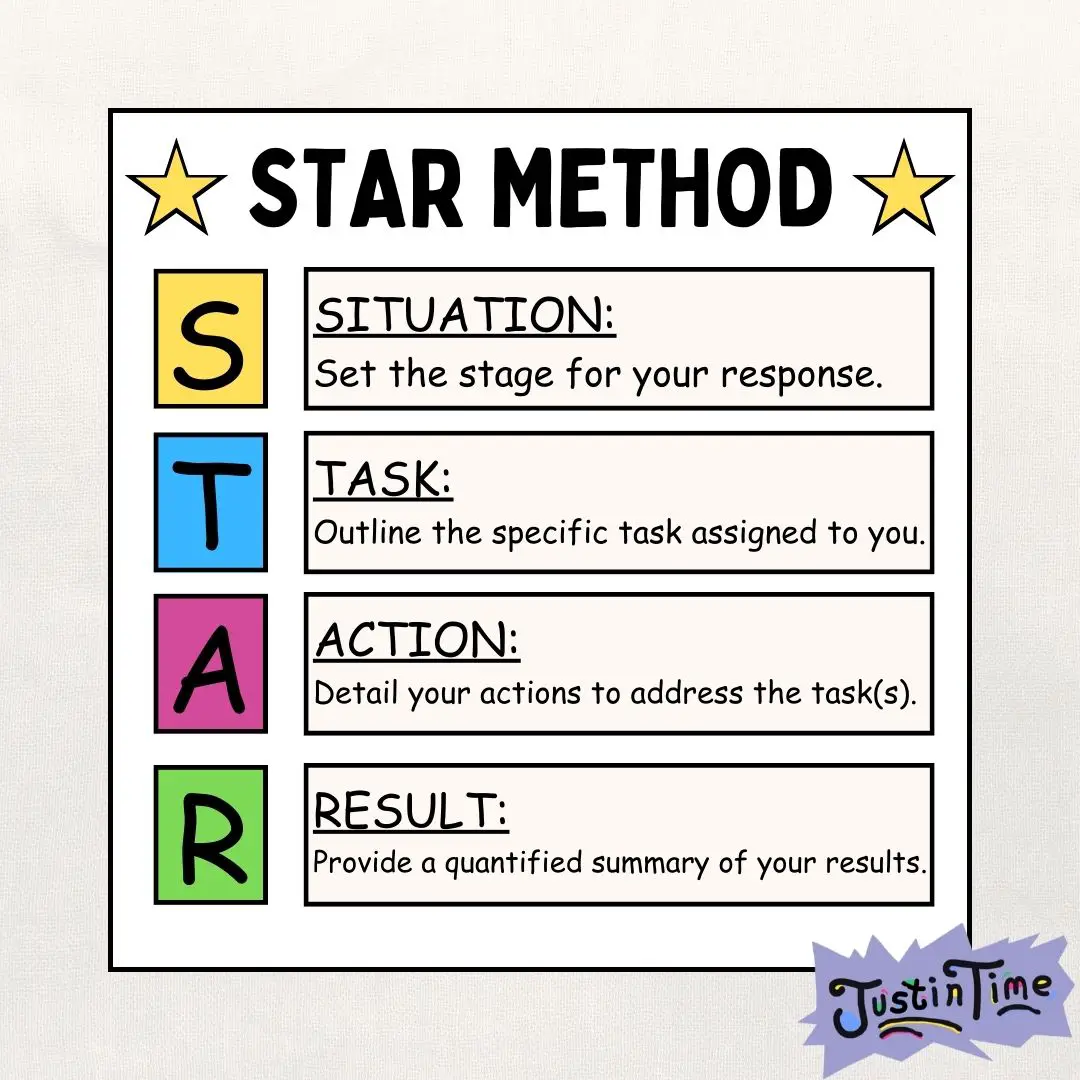

3) STAR Method Interview Questions

Lastly, this is the most important type of interview question because many employers use the STAR method to assess your behavioral competencies and problem-solving skills. Expect questions like “Can you share an example of a challenging situation you faced as a claims adjuster?” or “If you have dealt with a frustrated customer, can you tell us how you handled it?”

In response, structure your answer using the STAR method. Begin by describing the situation or task, outlining the actions you took to address the challenge, and conclude by highlighting the positive results or lessons learned. This approach allows you to provide a comprehensive and structured response, showcasing your ability to analyze situations, take decisive actions, and achieve favorable outcomes. These interview questions take a lot of practice to ensure that you are well-prepared to answer them in the STAR format. If you struggle with these kinds of questions, you may want to read our blog linked below.

RELATED: BEST WAY TO ANSWER STAR METHOD INTERVIEW QUESTIONS

Resume Type Interview Questions for a Claims Adjuster

- Can you walk me through your resume and highlight the key milestones in your career as it relates to this role?

- This is typically a warm-up question so try not to assume the interviewer did not read your resume. They may be looking for you to provide a concise overview that highlights any significant roles and achievements.

- How many years of experience do you have in total?

- Employers often start with this question to gauge your overall experience level. Be honest about your years in the industry, as this helps them determine your suitability for the role.

- What year did you start working as a claims adjuster?

- Share your start date to provide context for your experience and show your commitment to the field. Do not lie because employers are trying to determine how much support you may need in the role they are looking to fill.

- What company did you work for, and was it a local or national firm?

- Give details about your previous employers, specifying whether they were local or national firms. There may be some companies listed on your resume that the interviewer is not aware of especially if the company is in a different field than the position you are applying for.

- What led you to pursue an insurance career and claims adjusting?

- Briefly share your genuine interest in helping individuals navigate challenging situations, and highlight any personal or academic experiences that sparked your passion for the field. Maybe you had an uncle who always traveled.

Claims Experience Interview Questions for a Claims Adjuster

- What is your national producer number?

- Depending on what information you list on your resume, you may be asked this so that the employer can verify your licenses.

- What licenses and certifications do you hold?

- Be prepared to list the licenses you hold, showcasing your legal qualifications for the role.

- What specific insurance-related training have you completed?

- Describe any training or certifications you have completed to highlight your commitment to professional development, whether in-person or hosted virtually.

- Rate your experience level with Xactimate/CCC One/Mitchel on a scale of 1 to 10.

- Xactimate is the industry standard for property adjusting, while CCC One/Mitchell is the standard for auto-adjusting. Be ready to rate your familiarity and expertise with the respective tools depending on the position you are applying for as an adjuster.

- When was your last deployment, and can you provide the exact dates?

- Provide precise deployment dates to illustrate your recent experience and reliability. Explain the types of deployments you have experienced, such as catastrophe claims or daily adjusting, to showcase your versatility.

- How long were you typically deployed during assignments?

- Share the duration of your deployments to reveal your ability to commit to assignments. You may want to state deployments that ended earlier than you planned and why they did to paint a vivid picture of your ability to work an assignment to the end if possible.

- What types of claims have you handled throughout your career?

- Detail the specific types of claims you have managed, including property, auto, or liability claims. You will also want to detail the damages you have assessed, such as hailstone size measurements, to demonstrate your expertise.

- How many inspections did you typically perform per day during your assignments?

- Describe the number of daily inspections, emphasizing your thoroughness and attention to detail. Share your daily workload to demonstrate your efficiency and productivity.

- At the end of your deployment, how many claims did you successfully close in total?

- This metric showcases your effectiveness in resolving claims, so provide a precise number. The inspected-to-close ratio is a key metric and if you have a ratio above 70%, you definitely want to highlight that information.

- What types of perils have you dealt with, and can you provide an example of a particularly complex peril you’ve assessed?

- Specify the perils you have encountered, such as hailstorms, floods, or fires.

STAR Method Interview Questions for a Claims Adjuster

When answering these types of interview questions, focus on your ability to empathize, communicate, and resolve issues effectively. Remember to use the STAR (Situation, Task, Action, Result) method to structure your response:

RELATED: LEARN HOW TO USE AI TO ANSWER STAR METHOD INTERVIEW QUESTIONS

- Can you share a situation where you successfully negotiated a settlement with a challenging policyholder?

- Describe a time when you had to handle a complex claim involving multiple parties. What was your approach?

- Share an experience where you had to investigate a fraudulent insurance claim. How did you handle it?

- Discuss a situation where you had to make a quick decision regarding coverage. What factors did you consider?

- Can you provide an example of a claim you processed that required collaboration with legal experts? How did you navigate it?

- Describe a time when you had to manage a high volume of claims under tight deadlines. How did you prioritize and ensure accuracy?

- Share a situation where you had to communicate difficult decisions to a policyholder. How did you handle it sensitively?

- Discuss an instance where you identified and implemented process improvements in claims handling.

- Can you give an example of a claim where you had to coordinate with external agencies, such as law enforcement or medical professionals?

- Describe a time when you had to handle a claim involving severe weather or a natural disaster. How did you ensure a timely response?

- Share a situation where you had to negotiate with repair shops or contractors to ensure fair and efficient claim resolutions.

- Discuss a claim where you had to analyze extensive data and use it to make informed decisions. What was the outcome?

- Can you provide an example of a claim where you had to work closely with underwriters to assess coverage and liability?

- Share an instance where you had to handle a claim involving a policyholder in a challenging financial situation. How did you approach the case?

- Can you give an example of a claim where the software you were using (e.g. Xactimate or CCC One) was not working? How did you handle it?

Conclusion

When it comes to landing a job in today’s economy, preparing for success is not just an option; it’s a necessity! In the famous words of Denzel Washington, “It’s chess, it ain’t checkers!” You do not want to roll into an interview like a rookie. Rehearse your answers, know your script, and show them you are the real deal – the one they cannot afford to pass up. In this game, preparation is not just key; it is the master key to opening the door to your next big move.

Even though this may seem like it is written for office interviews, if you are an independent adjuster and you get the call for a deployment opportunity — that’s your interview! By practicing your responses to these common interview questions ahead of time, you will always be able to leave a lasting impression on ANY potential employer. Training day ain’t over until you have aced that interview. Good luck with your interview questions! You’ve got this! 🌟