Home of JustinTime Blogs

Everything You Need to Be the Best Insurance Adjuster

Claims Adjuster Careers: A Comprehensive Guide to Starting (2024)

Are you considering a career in claims adjusting? If so, you are in the right place. Claims adjuster careers offer a unique opportunity for individuals with a keen eye for…

How to Dominate Your STAR Method Interview Using AI – 2024

I have spoken with many individuals who are really good at their jobs and/or are transitioning from another field with a lot of ambition to prove they are worthy candidates…

Interview Questions You May Be Asked For a Claims Adjuster Position

One of my favorite movies is Training Day featuring Denzel Washington and Ethan Hawke. Now, you may be wondering what the movie Training Day has to do with answering interview…

Learn Everything That You Need to Take Better Care of Your Hair at Home

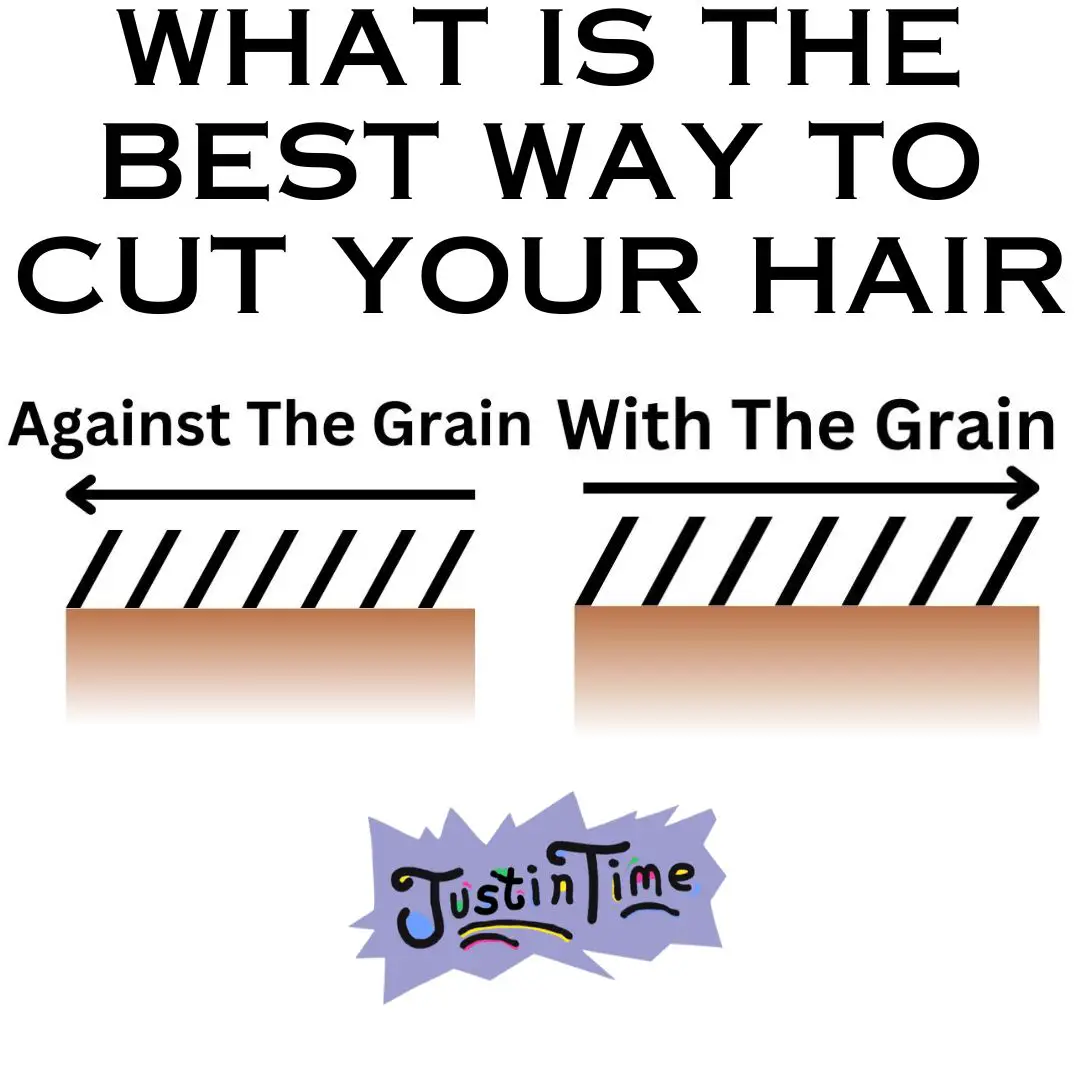

Cutting Hair Against the Grain vs With the Grain

When it comes to achieving the perfect haircut and well-defined waves, understanding the concepts of cutting hair against the grain and with the grain is essential. These techniques play a…

Understanding Clipper Guards for Perfect 360 Waves

Introduction Hey there, it’s your boy Jay Lew, and I’m excited to welcome you to this comprehensive guide on achieving flawless 360 waves by understanding clipper guards before cutting your…

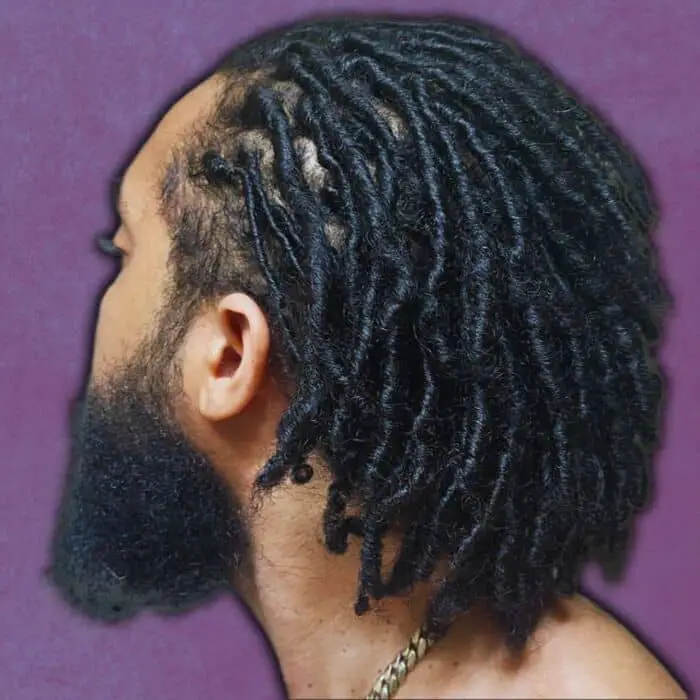

Ending My Curly Loc Journey with Insane Hair Growth – 2023

Introduction: Embracing Change Hey, what’s up, everyone! It’s your boy Jay Lew, and I’m excited to share something new with you all today. It’s been a while since you’ve seen…